From stockbroker to private bank

Delen Private Bank has come a long way since its establishment. In over 85 years, the Antwerp brokerage firm 'Delen & C°' transformed into a modern private bank specialised in wealth management and wealth planning.

The story of a family business with strong roots

In 1936, 32-year-old André Delen founded the brokerage firm ‘Delen & C°’. Armed with a pen, a notebook and the newspaper, he placed orders on the stock market and successfully applied the principle of responsible wealth management.

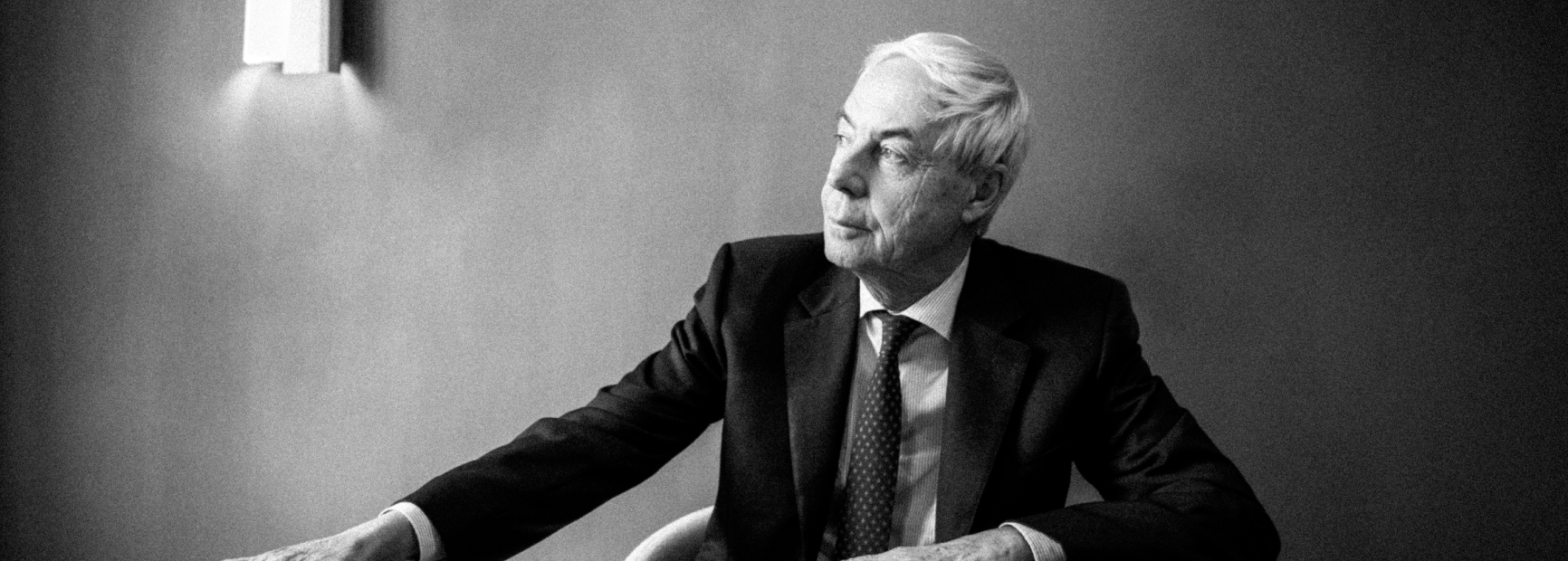

The services of Delen Private Bank have evolved considerably since then. In the video below (available in Dutch), Jacques Delen, chairman of the board of directors and former CEO, tells you more about the evolution of Delen and the leitmotiv in the bank's story.

1936

Foundation stockbroker Delen & Co by André Delen1975

Jacques Delen becomes CEO

Jean-Pierre, Paul and Jacques Delen follow in their father’s footsteps to head the brokerage firm. They ensured the further development of the bank while maintaining its unique familial nature.

1990

Paul De Winter provides the impetus for discretionary asset management

From the 1990s, Delen focused on what is the bank's calling card to this day: discretionary asset management.

1992

Merger with investment company Ackermans & van Haaren

1994

Acquisition of Banque de Schaetzen1995

Launch of Estate Planning1996

Cooperation agreement with stockbrokers De Ferm1998

Bank Van Breda & Delen Private Bank join forces2000

Acquisition of brokerage firm Havaux

Chairman René Havaux joined the board of directors and executive committee of Delen Private Bank immediately after the acquisition.

2004

Acquisition of Luxembourg-based AXA subsidiary Banque BI&A2007

Merger with Capital & Finance (Capfi)2007

Asset management is centralised via patrimonal fund strategy2011

Majority stake in JM Finn & Co (London)2014

Paul De Winter becomes CEO, Jacques Delen becomes chairman of the board of directors2015

Acquisition of Oyens & Van Eeghen NV (Netherlands)

2019

Appointment of René Havaux as CEO2019

Launch of Delen Family Services2019

Acquisition of Nobel Asset Management (Netherlands)2022

Appointment of Michel Buysschaert as CEO.png)

2024

Acquisition of Puur Beleggen (Netherlands)2025

Strengthening services related to Family and Wealth2025

Acquisition of Dierickx Leys2025

Acquisition of Petram en Servatus (Netherlands)Want to know more?

With Delen's responsible wealth management, you choose peace of mind while retaining control of your assets. A relationship manager will be happy to tell you more about it.